From chequing accounts with unlimited transactions and monthly fee rebates, to savings accounts that may help you achieve your financial goals, TD offers a range of personal bank accounts to help you manage your money. Compare the differences between a chequing and savings account so you know which type of bank account is best suited for you. Currently, person-to-person payments and transfers are available to and from U.S.-based bank accounts only.

Download our mobile app to get on-the-go access to your accounts and bank securely 24/7. Anywhere you are, view your balance, deposit checks, send money, transfer funds, pay bills and more. TD offers clients the possibility of opening a personal foreign currency account in pounds sterling.

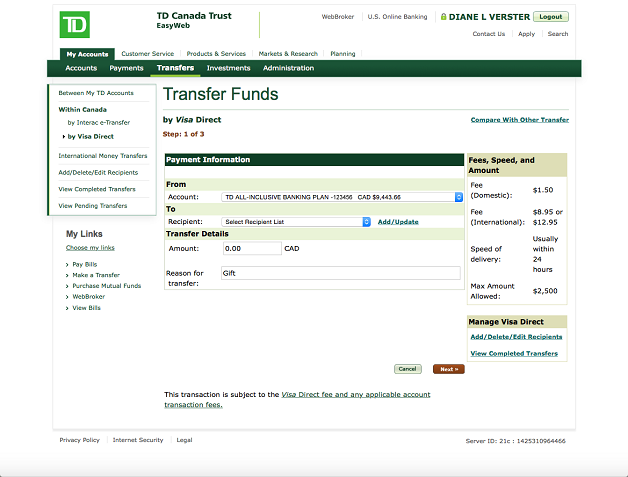

Customers who maintain a balance of at least £500 at the end of each month pay no monthly fees whatsoever. You get unlimited transactions with no fees, but you can't bank via ATM machine, EasyWeb, or debit payment. Another aspect of TD bank's online banking service is TD Bank EasyWeb. The Easyweb is mainly for business people, but anybody who is 18 years or older, a Canadian resident and has a TD personal or business banking account can register. This online service lets you manage your business banking anywhere and anytime. You can monitor your accounts, pay bills, transfer funds and much more from your office, home or on-the-go.

TD Bank partnered with Fiserv to offer Popmoney® to provide customers person-to-person payment options, complementing the bank's convenient online banking tools. With Popmoney, customers can send money to or request money from people they know or owe, using that person's email address or mobile phone number. US Dollar TD Every Day Business Three monthly plans with fees based on the number of transactions, 50 deposit items, and monthly fee rebates for balances starting from US$20,000. US Dollar Basic $1.25 per transaction , $0.22 per deposit item, $2.50 for every $1,000 cash deposit, $5.00 monthly plan fee. With the borderless account, your business can get its very own local bank details for several regions around the world – so your clients can pay and get paid locally.

With over 1,250 locations throughout the Northeast and Southeast regions of the U.S., TD Bank offers a robust brick-and-mortar presence and an array of checking and savings account options. For consumers who value banking with a big brand that has a large physical footprint, as well as those who prioritize checking and savings accounts that offer competitive sign-up bonuses, TD Bank could be a good choice. However, compared with other banks — particularly online banks — TD Bank falls short in terms of offering competitive rates and minimizing fees. You can withdraw cash at any TD ATM in Canada regardless of its location.

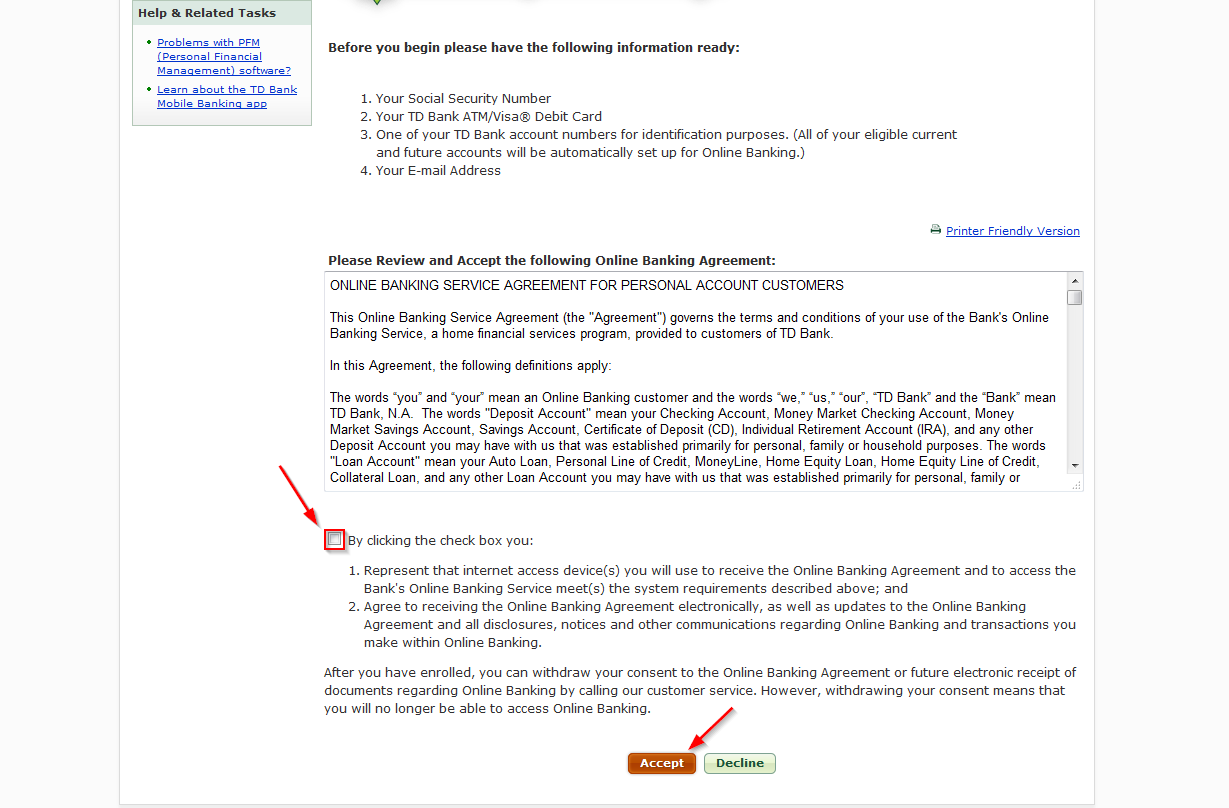

For TD ATMs located at or near a TD branch, TD personal banking customers can also deposit money , pay bills, check account balances, and transfer money between TD personal accounts. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address and a social security number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. If you're looking for a no-frills checking account, the TD Simple Checking has a $5.99 monthly maintenance fee no matter how much you have sitting in the bank. You get just the basics with this checking account, such as free online statements and free access to TD's mobile bank app.

Small business clients are offered foreign currency accounts in several denominations. There's sadly no information on the foreign currency accounts that you can get, besides US dollar ones. Instead you need to visit a branch for details, as their Small Business Foreign Exchange page instructs.

A modern financial service like Wise uses the mid-market rate on all transfers and conversions. You pay a small fee and with it's free to open a borderless multi-currency account, that has no monthly fees either. There you can manage and send dozens of different currencies all from the same account. Soon you will also be able to get a multi-currency debit card. In a proven case of online fraud, you are protected by the 'Customer Services Rules', which ensure that your funds are returned to your bank account by your Financial Institution.

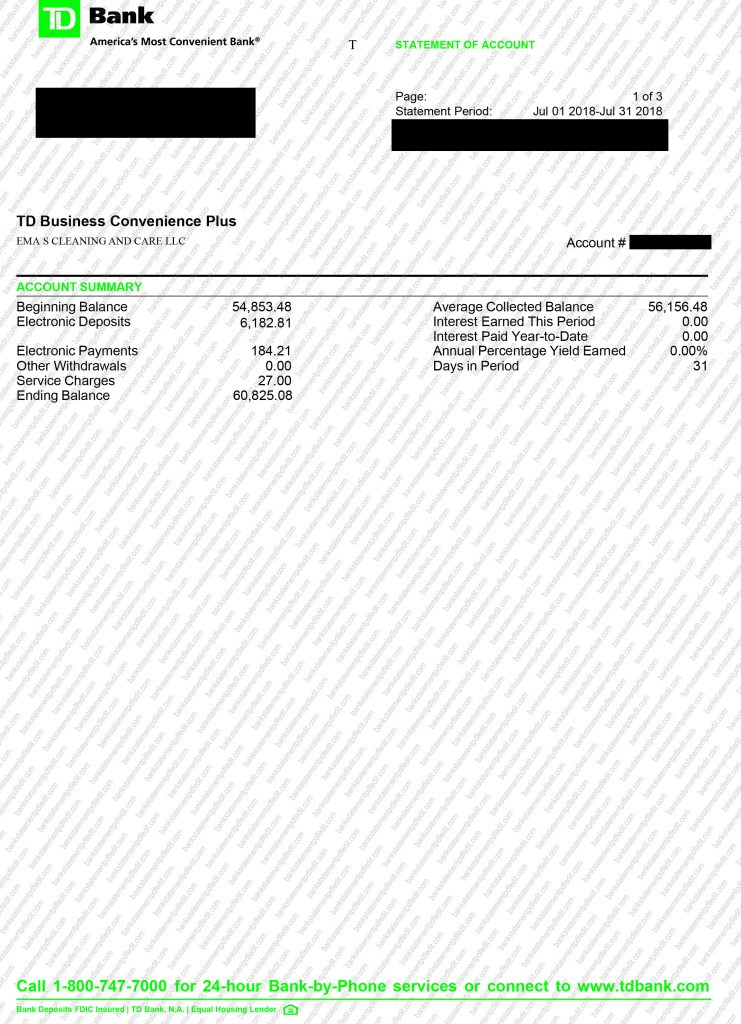

These 'Rules' are based on the reputable Canadian Code of Practice for Consumer Protection in Electronic Commerce. While we work with all stakeholders, as well as security experts, to maintain the ongoing security of our services, there are actions that you can take as well. You are encouraged to regularly check your bank statements to verify that all transactions have been properly documented.

If entries do not accurately reflect transaction activities - for example, if there are missing or additional transactions you should immediately contact your financial institution. Thankfully, many banks are beginning to understand the need for fast and easy banking, especially in the digital age. These days, banks are stumbling over themselves to provide customers fast, easy, secure and efficient ways to access funds at the click of a button. TD Bank Online is one of such banks, and they offer a variety of easy and secure online banking services. TD Bank is worth considering if you're looking for a bank with great customer service and a few options for checking at different stages of your life. However, if you're looking for a bank in which to park your money to earn interest, the rates are quite low.

What's more, you'll need to mind the minimum required balances for the monthly bank account fee to be dropped. You should have an option for zero star review but I'll give you a one-star since it's not there. After 11 years of being a customer you guys have screwed me over not once but twice. After reading multiple reviews I've noticed I'm not the only one that's being screwed over with monthly payments. I really appreciate you know waking up and finding out that you returned an important payment just to take out the $16.95 that you needed for the stupid monthly payment.

After having the fiance talk to you know one of the managers I have decided to say screw it and cancel my bank account because they don't care. We were told blankly on the phone that it is my responsibility to make sure money is in the account the money was in the account they don't know when to update their system so I know when I need to put more money in. One thing to note about PNC is that its monthly fees are significantly lower than TD Bank's, but PNC Bank requires a higher minimum balance of $500 to keep its standard checking account free from month to month.

If you're just looking for a standard checking account, TD Bank may be an easier option for affordable checking. In a proven case of online fraud, you are protected by the 'Customer Services Rules', which ensure that your funds are returned to your bank account by your financial institution. 1Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number and an active unique e-mail address. Message and data rates may apply, check with your wireless carrier.

Best of all, Transferwise makes it very easy for me to move my USD income into whichever bank and currency I choose. If I want to transfer those US dollars into my USD bank account with TD Bank in the States, so I can pay my US Visa card, no problem! If I want to turn them into Canadian dollars in my TD Canada Trust, no problem! I can convert the money myself, at Transferwise's great rates, and then transfer the money to my Canadian account.

It takes a couple of days for the transfer to go through but it's hassle free. Below is the official TD fee schedule for foreign currency accounts. They come with no transaction fees and they offer unlimited transactions. But banking via EasyWeb Internet Banking, ATM machines, and debit payment purchases are out of the question. Customers looking for a personal account in euro can opt for a foreign currency account in exchange for a monthly fee of EUR 1.75.

As above, they can make as many transactions as they wish without paying any additional service charges. However, they can't use ATM machines, EasyWeb Internet Banking, or debit payments to manage their transactions. Everything is robotic, do it youself banking, but pay high user fee's. After speaking with them, I, find out, it's not really Visa.

They'll tell you anything, to get you, to do Voice Activating banking, elimating more jobs. Done with this bank, horrible, non existant personal banking, "sorry, we're having technical problems right now, call back later". Some days, 15 minute wait and longer, to do a bank transfer with Easy line customer service, which I, pay for. They don't want your business, unless you've invested every last penny from your life or won the lottery. When you make a payment, your financial institution's online banking app or website will display the date your payment was made. Payments are usually received by the CRA within 5 business days.

To avoid fees and interest, please make sure you pay on time. You can pay your personal and business taxes to the Canada Revenue Agency through your financial institution's online banking app or website. Most financial institutions also let you set up a payment to be made on a future date. As a leading customer service provider, TD Bank Canada Trust offers a broad range of financial products and services to personal and small business customers.

As part of the TD Bank Financial Group, with headquarters located in Toronto and offices around the world, TD Bank Canada Trust administers anywhere, anytime banking solutions through telephone and Internet banking. We feature more than 2,600 ATMs and a network of approximately 1,100 branches across Canada. And there's a monthly fee of $5, which is waived if you can maintain a $300 minimum daily balance. For the first 12 months only, you can avoid the fee by transferring $25 monthly from a TD checking to savings account.

For customers with larger balances, TD Beyond Savings can earn higher rates, but if your balance falls below $20,000, the monthly fee is $15. That's why we offer a range of bank accounts – from basic savings & chequing to borderless. We also make it easier for you to bank the way you want, when you want – online, mobile, or in-person. Let us help you open a TD bank account that's just right for you. TD Beyond Savings is for those who keep high balances of $20,000 or more in their savings accounts. If you have less, you will be charged a $15 monthly fee.

With a linked TD checking account, you'll earn 0.02% if you have at least $20,000, working your way of up a tiered system to 0.05% if you have $250,000 or more in the account. If you can maintain a daily balance of at least $2,500, TD Bank will reimburse you for all ATM fees incurred. Another standout checking account is TD Bank's Convenience Checking account, as it requires a low minimum balance of $100 to waive its $15 monthly maintenance fee. Once enrolled, your eligible TD Canadian dollar personal banking accounts and credit card accounts will automatically be added and ready for tracking in MySpend.

You can disable any account you do not want to track and display. Spending from accounts that you disable in Preferences will continue to be tracked by TD MySpend but will not be included in the spending meter. Our Mobile Banking App offers convenience on the go while you are out and about. You can check your account balances, view and perform transactions, and view your check images.

Our funds transfer feature allows you to move funds immediately between your accounts or schedule future transfers. Our bill pay feature is easy to use and you can pay almost any company or person. Most accounts offer a limited number of free transactions per month.

Once the limit is exceeded, there'll be a fee of about CAD$1 per transaction. While some accounts offer unlimited free transactions, they'll have higher monthly fees and greater minimum balance requirements. No foreign transaction fees on a debit card – If you prefer to use your debit card while traveling internationally, there are usually no foreign transaction fees to pay on TD Bank's debit card. It depends what account you have, but many have no foreign transaction fees.

TD Bank also makes it easy for travelers to order foreign currency, whether or not you have an account. The interbank rate, also known as the mid-market rate is something you probably want to know about. It's the rate, that banks use to trade among each other. When money exchange services and banks set their own rates to sell you currency, it can be considered a additional fee. You may get very different rates, with varying levels of markup, from different providers. And should you frequently be exchanging currency or dealing in large sums, it can add up quite quickly to bigger amounts.

While it is the standard practice of financial institutions to use a markup on the rate, the downside of this practice is, that you do not know the percentage of markup that's being used. That percentage is still a cost that the buyer of the currency will take on. And as it varies by who is selling it to you, it would give a better overview of the total fees, if this was disclosed in a more clear way. TD Bank offers a number of options for checking customers. It's popular TD Convenience Checking account comes with just a $100 minimum daily balance requirement to dodge the $15 monthly fee. TD Bank offers customers a few different options for savings.

With its Simple Savings account, you can earn interest, but it comes with a $5 monthly fee. Luckily there are a few easy options available for getting the fee waived, such as keeping at least $300 in the account. Students and seniors do not have to pay the fee either. TD Bank's student and senior options are also quite beneficial for younger or older customers, respectively. Students ages of 17 through 24 will pay no monthly fee, while seniors can easily avoid paying a monthly fee with just $250 in their account. This is a departure from TD's larger competitors, which typically require even students to meet certain banking activity requirements before they can waive monthly fees.

Areas in which TD Bank falls short are its fees and interest offered. While many checking and savings accounts have no monthly maintenance fees without needing to meet any qualifications, many of TD Bank's products require customers to jump through hoops to get their fees waived. Additionally, the interest offered on TD Bank's deposit products is minimal when compared with the bank's online-only peers. This review covers everything you need to know about TD Bank so you can determine whether it's a good option for you.

While TD Bank offers a variety of financial services, this review focuses on its checking and savings account products. Yes, you can use the INTERAC® Online service on any computer where you can access the Internet and your financial institution's online banking service. Check with your financial institution for advice on how to safely bank online when using a public computer. TD Choice Promotional CDs have terms from three months to five years, and the bank offers other types of CDs that don't have penalties or offer annual rate increases. You can get a rate increase for TD Choice Promotional CDs with a checking account in good standing, but overall you can find much higher rates elsewhere. For any New Account that is a joint account, at least one account holder on the New Account must meet the eligibility requirements.

Limit of one $75 Amazon.ca gift card offer per customer, per New Account. We can change, extend or withdraw the $75 Amazon.ca Gift Card offer at any time, and it cannot be used in conjunction with any other offer or discount for the same product. All amounts are in Canadian dollars unless otherwise noted. As we mentioned earlier, your insurance company will use your routing number and the number for your specific TD bank account to set up pre-authorized payments for your monthly insurance premiums. They'll do this by creating an electronic link between your bank account and their bank account. This way, they can automatically withdraw your insurance payment from your bank account each month.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.